‘History shows European financial stability may be a bridge too far, leaving investors in extreme peril when it fails’

It is not one of the market’s most attractive traits when it ends up extremely long on bravado and exceedingly short on memory. It can be a fatal flaw when things start to go wrong. Europe has been to hell and back in recent years, when existential crisis almost ripped the heart out of the euro zone and the single currency. But now European financial markets have turned into one the major darlings for global players, it begs the question whether investors could end up long and wrong again.

You would have thought investors got their fingers so badly burnt in the wake of the 2008 global financial crash, when European unity, economic well-being, financial stability and the euro currency almost went to the wall that the golden rule of ‘once bitten, twice shy’ would have been a paramount investment axiom for investors.

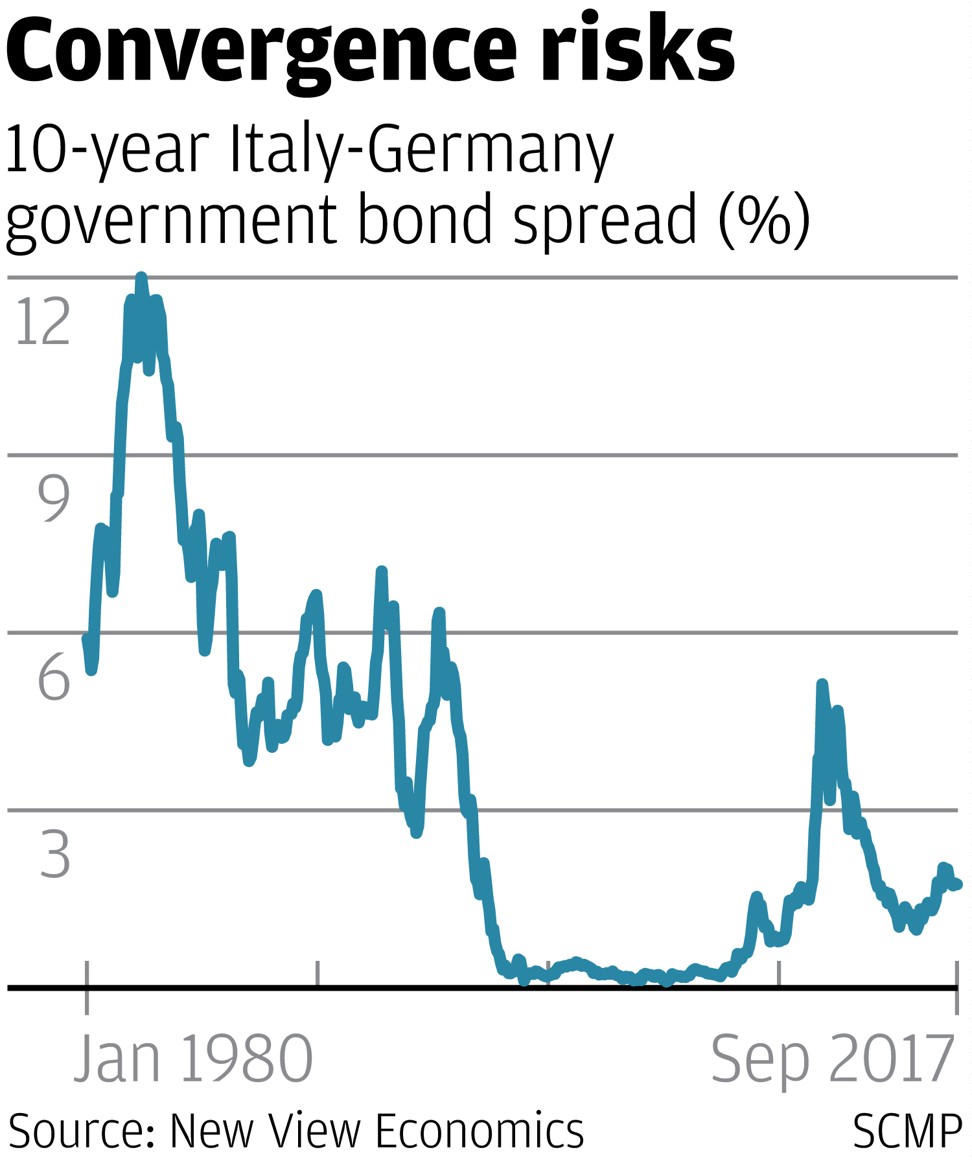

The precipitous collapse in credit ratings for many of the euro zone troubled economies during the dog days of the 2009-2013 European crisis, underlined correct risk assessment at the time, especially when the only willing buyer of their distressed debt was the European Central Bank in stability-driven, special market operations. The key question is what makes investors more confident now about Europe’s outlook. Germany holds the key and last week’s national elections could mark a symbolic turning point.

Nearly a decade ago, the weaker and heavily-indebted euro zone economies, unfortunately saddled with the pejorative label PIIGS – namely Portugal, Ireland, Italy, Greece and Spain – were struggling to contain ballooning budget deficits and mountainous government debt exposures. They were close to collapse.

The global crash tipped investor confidence over the brink, investors rushed for the exits, credit spreads exploded and the European monetary union was close to extinction, same as the euro, whose days looked numbered. It was only a strong show of political unity from Europe backed up by significant bailout money and the ECB acting as lender of last resort that the day was saved.

Critically, German intervention at that time proved decisive. It had to be, especially when Chancellor Angela Merkel discovered the frightening exposure of Germany’s financial system to high-risk European investments. Had Merkel allowed peripheral European markets to fail, Germany’s banks and investment funds would have been dragged into a devastating contagion and default.

Today, Europe still remains a teetering financial edifice, propped up by ECB money and German guarantees of political and financial backing. Deep infusions of quantitative easing money have helped rebuild economic confidence and restore financial stability but little has been done to solve the region’s deeply troubling systemic faults.

Monetary super-stimulus has catapulted Germany’s economy to great strength, but the need for continuing austerity and debt restructuring in the problem economies still holds back European growth potential overall. Budget deficits are running far too high and government debt piles are unsustainable in the long term. Debt-to-GDP ratios running close to 175 per cent in Greece and 160 per cent in Italy cannot go on forever without the ECB and Germany picking up the tab.

And here lies the rub. European political unity, monetary union and the survival of the euro are beholden to continuing support from Germany, but that endorsement is now cast in doubt after September 24’s indecisive election result which saw the anti-Brussels, populist far-right AfD make big gains to third biggest party in the German parliament. It could mark a turning point in German politics which could shake the centrepiece of European cohesion and unity to its roots.

It could be an important harbinger for global investors. If Germany begins to drift towards political populism, national introspection and greater Euro-scepticism, then you can forget notions of closer economic integration, fiscal union and a common debt market. In which case, the argument for European convergence trades and the narrowing of bond yields in riskier markets like Greece, Italy and Spain towards German government debt will fall apart.

Bets on a stronger euro will take a hard hit too, swept aside by a rush into safe haven currencies. The euro may be on a winning streak versus the weaker dollar right now, but this could quickly unravel if investors really panic. If German politics are a game-changer and market sentiment crumbles, the euro is in trouble.

Global investors need to take a log hard look at Europe’s deepening political complexity. History shows European financial stability may be a bridge too far, leaving investors in extreme peril when it fails.

David Brown is the chief executive of New View Economics

[Disclaimer]