Venezuela Is Quietly Ramping Up Oil Production

If anyone is to ever write a guidebook on political survival, the skills of Venezuelan President Nicolás Maduro would certainly top the contemporary charts. This autumn went relatively well for the besieged leader as the political headlines drifted towards the US-China trade wars, OPEC+ production cuts, and the US impeachment saga. In fact, the weakening of media attention against the background of a rigid sanction regime nudged the Venezuelan authorities to render their economy a bit more market-based and also to throw more efforts into fighting the nation’s main scourge, hyperinflation. Yet once again elections in Venezuela are around the corner and the fragile stability might be jeopardized again.

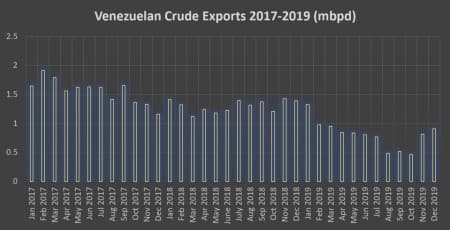

Graph 1. Venezuelan Crude Exports in 2017-2019 (million barrels per day).

Source: Thomson Reuters.

Let’s start first with crude and exports thereof. Bouncing back from a string of blackouts, outages, and fires, PDVSA managed to bring back its oil output to levels unseen since February-March 2019 (i.e. the December average stands so far at 0.91mbpd). This move corresponds with China’s return to official dealings with PDVSA or the intermediary Rosneft, without resorting to the exotic practice of new Malaysian blends. Increased production volumes also mean quicker paying-off of debts for PDVSA – as of Q3 2019 the Venezuelan NOC’s debt to Rosneft shrank to 800 million, implying that by the summer of 2020 PDVSA would fully absolve itself of all arrears vis-à-vis the main marketer of Venezuelan crudes now.

Although no Venezuelan crude reaches Russia in terms of actual exported barrels (see Graph 2), the increased role of the Russian national oil company has in many ways signaled the way forward for PDVSA, perhaps even inadvertently against its own will. Whilst previously PDVSA took great pride in operating all aspects of upstream projects, its still-existing joint ventures with Rosneft, Repsol, CNPC or Chevron have witnessed a tacit transfer of competences and responsibilities to its JV partners. Boosting JV production has a manifest advantage over other options for PDVSA – equity barrels are not subject to US sanctions (as well as debt repayments, however, these effectively bar Venezuela from receiving much-needed currency, whatever denomination it might be).Related: Is The Shale Boom Running On Fumes?

Graph 2. Venezuela’s Crude Exports by Main Export Outlets in 2018-2019 (million barrels per day).

Source: Thomson Reuters.

The January 2020 parliamentary vote might alter the abovementioned trends, primarily by making Venezuela a hotly contested topic again. The head of the Venezuelan National Assembly Juan Guaidó will be markedly backed by the US Administration, yet with no tangible successes to showcase – the army and internal services have remained under Maduro’s control, moreover, the opposition remains marred by corruption claims – he might have an even more difficult time than in 2017. Moreover, President Trump’s special envoy for Venezuela Elliott Abrams has vowed to tighten the sanctions regime yet a pronouncedly more aggressive US policy would only bring grist to Maduro’s mill.

As difficult as it may seem to put forward any forecasts for Venezuela in 2020, there exist several factors that would seem to augur a more favorable environment for Nicolás Maduro. First of all, the Maduro government has managed to slow down the exorbitant hyperinflation spiral, with the year-end inflation level for 2019 settling around 7-8 000 percent, a palpable difference compared to the 2018 level of 130 000 percent (the IMF anticipated hyperinflation at 10 million percent in 2019). This has been primarily attained by means of informal dollarization of the Venezuelan economy, whereby the American currency serves as the de facto price reference for goods. As PDVSA pays off its Rosneft debt and exports an increasing amount of crude to Asia, there should be an ever-increasing number of greenbacks in Venezuela. Related: Why The Saudis Suddenly Agreed To This Mega Oil Deal

Given that the Venezuelan Central Bank only holds hard currency to an estimated amount of $7.5 billion and that the economy is still some 90 percent dependent on oil income, Maduro’s primordial goal is to make sure that the crude exports are not cut short. As stated earlier, the upcoming National Assembly ballot on the future of Juan Guaidó (which will take place January 05, 2020) might jeopardize this goal – if the opposition leader is to keep or fortify his standing within the Venezuelan parliamentary system, despite arbitrary detainment of several opposition lawmakers, the current legal limbo might continue. Yet should Maduro gain the upper hand, the White House will surely ratchet up pressure on PDVSA and all its international partners.

Graph 3. Venezuela’s Refinery Runs in 2017-2019 (thousand barrels per day).

Source: OilX.

In the meantime, PDVSA still faces an upward battle to keep the company afloat – one need not look any further than the NOC’s desolate downstream segment, completely irresponsive to the relative rebound in Venezuela’s economic stature. After a year mired with blackouts and electricity shortages, following which much of the country’s downstream capacity has been rendered unusable (the 310kbpd Cardon refinery, part of the Paraguana Refinery Complex, remains offline up to the present day), refinery runs are still at 0.21-0.22mbpd, i.e. some 17 percent of PDVSA’s aggregate refining capacity (see Graph 3). PDVSA has tried to attract Indian investors for the task of revamping its decrepit refineries, signing a 5-year deal with an Indian consortium this November yet the actual results thereof are still to be seen.

As 2020 approaches President Maduro, the ultimate survival artist of our generation is bound to confront a new set of challenges. He has managed to clear several roadblocks in the past twelve months – easing inflation (effectively renouncing on his previous economic policy), boosting exports and paying pack debt wherever it is due. PDVSA cargoes are moving to China and India, with Singapore and Togo ship-to-ship transfers ending up in the same region complementing direct sales, moreover, PDVSA and Rosneft have found a modus operandi with crude shippers. Still, the landscape is murky for Maduro – the refinery segment is struggling for life, upstream’s long-term prospects are void without Chinese, Indian and Russian help, moreover, further US sanctions might be slapped on him anytime.

Source: https://oilprice.com/Energy/Energy-General/Venezuela-Is-Quietly-Ramping-Up-Oil-Production.html